Report expenses with Storhy

My expense reports

MY TEAM’S EXPENSE REPORTS

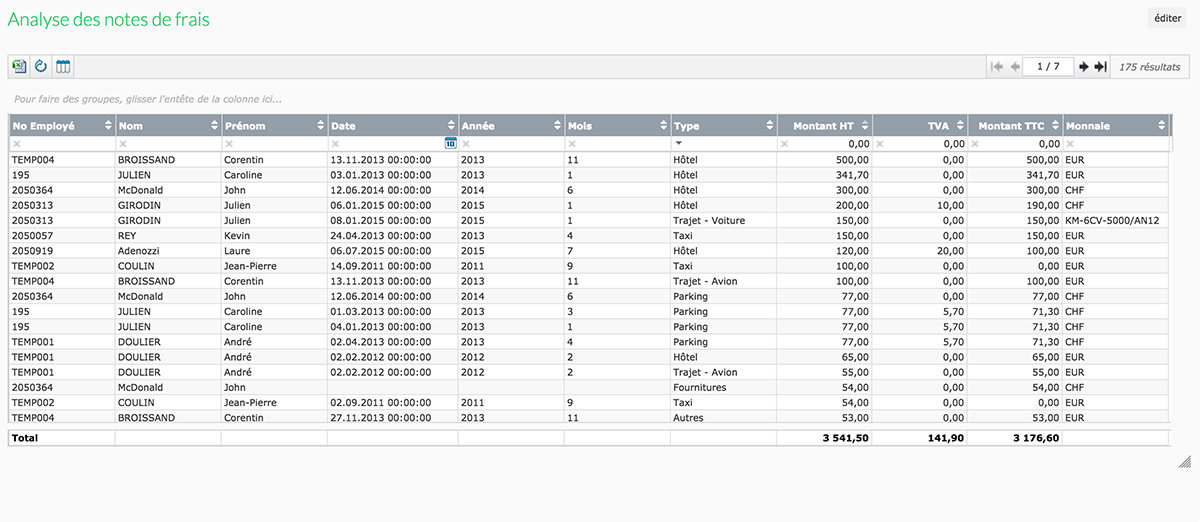

Analysis

The right process.

The employee

The employee submits an expense report from his/her own account. The employee imports supporting documents directly joined to the expense report.

The manager

The manager is informed that his/her subordinate has submitted an expense report. He/She can validate or reject the expense report, having all the information at hand.

The HR and accountings

The HR specify the accounting information: the employee is interested to know when the expense report will be reimbursed. The HR can send to the accountings the variable pay elements very easily. The expenses can be analyzed and filter to have a better understanding of what is going on in your company.

Frequently Asked Questions

Feel free to contact us if you have any questions!

We’re here to support you and ensure Storhy is a success for your organization!

Storhy, a pleasure.

Entering expense reports is no longer cumbersome and time consuming.

We save time and have greater visibility to our expenses.

And between us…I spend far less time now that I can view my report directly!

– A Storhy pilot client